COVID-19: How Can Telcos Offset Lost Revenues?

Despite the fact that COVID-19 has made telcos busier than ever (with increased demand for installations, a surge in data traffic, and high demands on customer service centres), unfortunately COVID-19 has brought with it a range of telco revenue killers. For example:

- Installations have slowed (due to lockdowns constraining network build and worker/transport movements);

- Handset purchases have decreased (not just because of reduced consumer spending, but because supply chain issues are affecting handset components);

- Payment defaults have gone up;

- 5G rollouts have been delayed (which means that associated sales revenue has been delayed);

- Digital and IT services revenue has fallen off (as companies delay decisions, and focus on the basics;

- Mobile business revenue has dropped (as people are not travelling for work); and

- Ad revenue has suffered – particularly from tourism and hospitality accounts, as well as sports advertising. Telcos such as Telefonica, BT Altice and AT&T, who rely on significant advertising revenue, are said to be particularly feeling the hit from the suspension of sporting events. Source

In terms of putting a figure on COVID-19-related losses, Analysys Mason published research results in April 2020 which predicted:

“Overall revenue declines are expected to amount to 3.4 percent in 2020 (against a previous forecast of an increase of 0.7 percent) with a modest rebound of 0.8 percent in 2021. Consumer services, which account for the majority (68 percent) of telecoms revenue, have a demonstrable level of resilience during economic downturns. The restrictions of movement in place in many countries and the emphasis on home working and entertainment means that fixed services perform relatively well. However, business telecoms will be badly hit. Increased unemployment, business closures and the overall decline in activity mean that spend by businesses on telecoms will fall sharply.”

Other headlines (and an associated fall in telco share prices) tell a similar story:

How can telcos offset lost revenues due to COVID-19?

There are many articles advising telcos on how to grow their revenues – pre, during and post-COVID-19. This Oliver Wyman article is a great example. But, given that atmail’s expertise is in email platforms, we’re going to focus on growing revenue via email platforms.

Isn’t email dead? No. Despite the regular clickbait headlines, people are still obsessed with email. Globally, three million emails are sent per second, and Adobe found in their 2019 Email Usage Study that on average, consumers spent five hours on email per day (three hours at work, two hours at home). Even Slack’s co-founder Stewart Butterfield has said, “There isn’t really an alternative [to email]. Sometimes people will have Facebook messenger turned on, but 99 percent of the time if you’re sending a message to a human you don’t know well, you’re using email.”

And given that most telcos already offer email in their service portfolio, it makes sense to better tap into it (during this period of budget and expansion cuts) to offset lost revenues due to COVID-19.

How can telcos use their email platform to grow revenue?

1. Charge true value to consumers

As we discussed in our recent post, Email Pricing: 3 Tips Telcos Can Learn from Hosting Providers, we found in our 350+ hour research study that most telcos either:

(a) gave email away for free (typically in a product bundle); or

(b) did not charge the true value of their email offering.

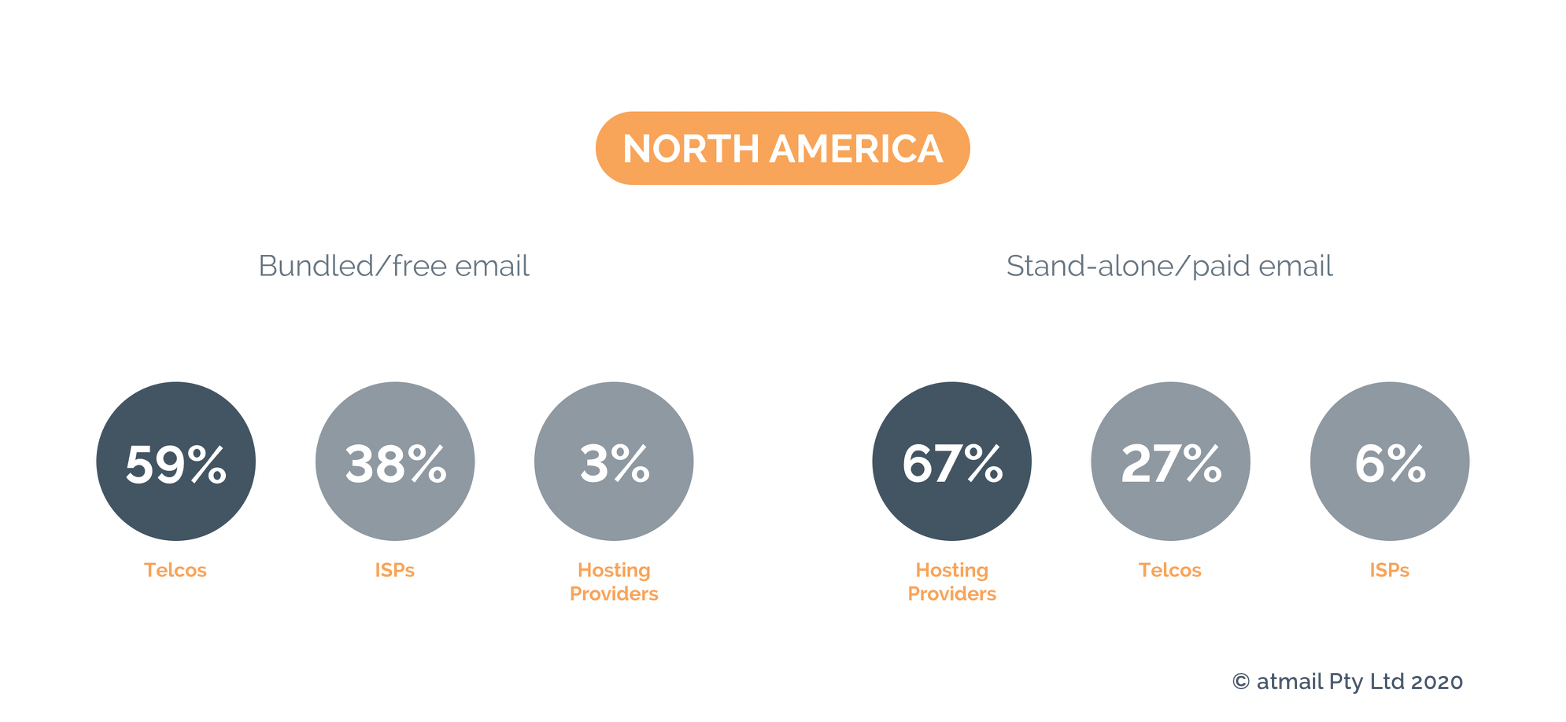

In North America, telcos made up 59 percent of the companies that gave email away for free.

In Europe, the figure was even higher, at 69 percent.

Yet, hosting providers in those same two regions had no qualms about charging for their email services. The hosting provider data that we found confirmed two important observations:

(a) hosting providers understand the true value of their email offering; and

(b) consumers will pay for email.

2. Offer an SMB email product

Savvy email providers know that there are three distinct email segments: consumer; SMB; and enterprise.

Yet, in our same research study, we found that most telcos that currently offered an email service for SMBs, were purely reselling Microsoft or Google, rather than offering their own SMB email product.

These telcos are losing out on at least four fronts:

- Relevance

- It’s hard to build a relationship with SMBs if you don’t offer a product that’s more suited to what they need.

- Affordability: Many SMBs do not need (or like) the high collaboration (and high cost) of Microsoft 365 or G Suite. COVID-19 has reminded SMBs that if they don’t need an expensive option, they don’t want to pay for it. Telcos need to understand this and offer a mid-range product that’s more suitable and affordable to SMBs.

- Self-brandability: Another way to add value to their SMBs is to offer an email service that each SMB can brand themselves. SMBs don’t want to Microsoft and Google logos, when they can see their own logo instead.

- It’s hard to build a relationship with SMBs if you don’t offer a product that’s more suited to what they need.

- Mindshare

- By not offering their own white label email service, telcos are surrendering a prime opportunity to keep their brand ‘front of mind’ with their SMB customers (for those SMB customers who don’t choose to self-brand);

- Retention

- At some point, customers who only see Microsoft or Google’s logo on their email, might question why they don’t buy from the tech giants directly. This should ring alarm bells for telco execs on the hook for revenue and retention.

- Profits

- Reselling Microsoft and Google products typically offers only a very thin reseller margin. It might make sense to resell these high collaboration products to enterprise customers, but if telcos are looking to keep more profits in-house, they would be wise to offer a different email service for SMBs, that generates higher profits for the telcos.

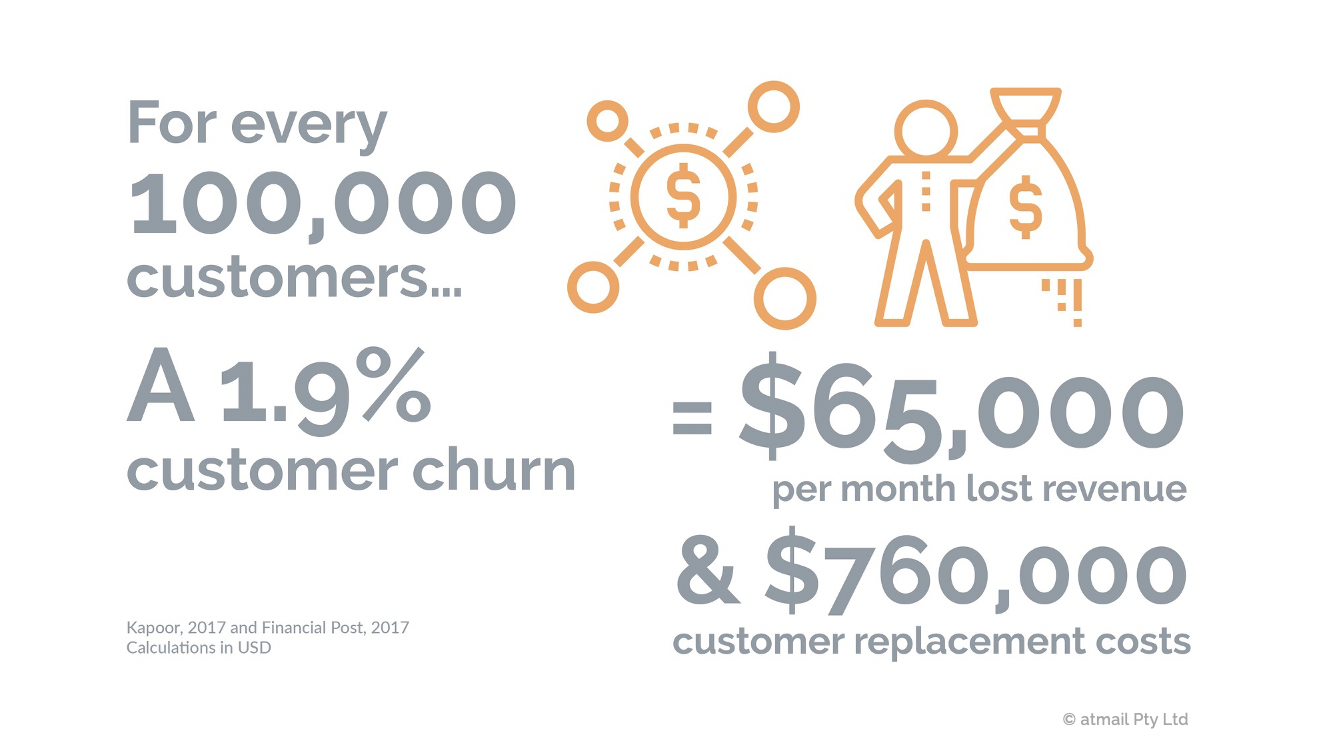

Source: Kapoor 2017, Financial Post 2017

Recap

With no clear end in sight for COVID-19, and much-reduced budgets for innovation and expansion, telcos should better tap into their existing offerings to compensate for lost COVID-19 revenues.

One easy win in this regard is to better use their email platform to grow revenues by: charging true value to their consumers; and offering a more relevant, affordable and win-win SMB email product.

New to atmail?

atmail is an email solutions company with 22 years of global, white label, email expertise. You can trust us to deliver an email platform that is secure, stable and scalable. We power more than 170 million mailboxes worldwide and offer modern, white-labelled, cloud hosted email with your choice of US or (GDPR compliant) EU data centres. We also offer on-premises webmail and/or mail server options. To find out more, we invite you to enquire here.

![How to Grow Revenue with Email Platforms [Live Webinars]](https://www.atmail.com/wp-content/uploads/2020/06/Webinar-banner-Revenue-Americas-LinkedIn-185x125.png)